Can Rail Freight Solve Port Congestion in Rotterdam and Antwerp?

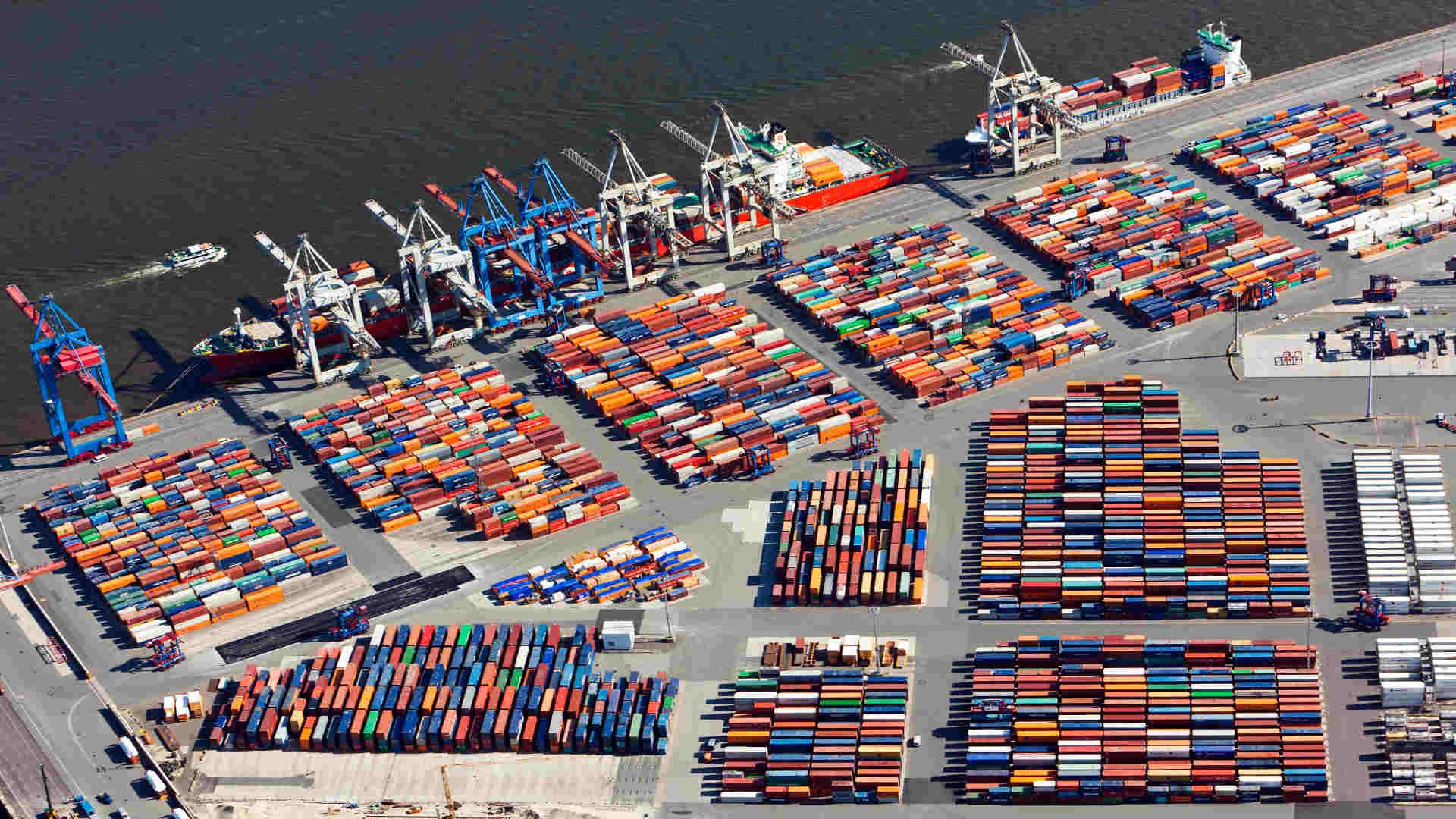

Every week, importers and exporters using the ports of Rotterdam and Antwerp–Bruges face growing delays, rising costs, and unpredictable delivery times. The cause is clear: port congestion is worsening. As container terminals struggle with overflowing yards and gridlocked truck lanes, businesses are looking for practical, sustainable solutions to keep cargo moving. Enter Dutch Rail Freight — a mode once seen as secondary, now emerging as a critical tool in stabilizing Europe’s supply chain.

The Current Congestion Crisis at Rotterdam and Antwerp

The ports of Rotterdam and Antwerp handle enormous trade volumes every day, and recent years have pushed both to their limits. Vessel waiting times have stretched into several days, while terminal yards struggle to keep up with container throughput. Inland transport—by truck, barge, and rail—has become equally congested, creating a chain reaction of delays across Europe’s logistics network.

For businesses that depend on efficient operations, this congestion translates to mounting demurrage charges, unreliable delivery schedules, and increased transportation costs. It’s no longer just a maritime problem; it’s a landside crisis affecting every part of the supply chain.

What “Dutch Rail Freight” Really Means

Dutch Rail Freight refers to the transport of goods—particularly containers—via the Netherlands’ rail network, connecting the major seaports to inland European destinations. This includes block trains, intermodal services, and single-wagon-load operations that move seamlessly between port terminals and inland hubs.

At the heart of this system lies the Betuweroute, a dedicated freight corridor linking Rotterdam to Germany, along with critical classification yards such as Kijfhoek. Together, they form the backbone of a rail network designed for high-volume, long-distance transport across Europe. For businesses, understanding how these corridors function is key to tapping into faster, more reliable connections beyond the congested roadways.

How Rail Freight Can Relieve Port-Based Congestion

Rail freight offers several distinct advantages in reducing pressure at Rotterdam and Antwerp.

- Reducing truck traffic: By shifting cargo from road to rail, terminals experience fewer truck queues and shorter gate dwell times.

- Bypassing barge disruptions: Low water levels on the Rhine often disrupt barge operations, but rail remains largely unaffected.

- Providing scalable capacity: Dedicated train slots enable the steady evacuation of containers from overcrowded terminals.

Port authorities themselves recognize rail as essential to landside relief. For logistics managers, treating a “train slot” as a key supply chain asset, rather than an afterthought—can transform planning and performance outcomes.

Infrastructure and Capacity Challenges

Despite its promise, Dutch rail freight still faces significant bottlenecks. Rail accounts for only around five percent of total inland freight transport in the Netherlands. Limited rail slots, outdated terminals, and constrained “last-mile” connections often make it difficult to scale rail capacity at the pace congestion demands.

Cross-border interoperability is another challenge. Trains moving between the Netherlands, Belgium, and Germany must align with differing signaling systems and scheduling protocols. Businesses adopting rail must therefore plan around these operational realities and choose logistics partners capable of navigating them efficiently.

Commercial and Operational Considerations

When deciding whether to incorporate rail freight into your logistics mix, three key factors stand out:

- Reliability: Rail may require advance booking but provides more consistent lead times than road transport, especially during port congestion peaks.

- Cost efficiency: Though rail can have higher upfront costs, its per-container cost becomes competitive over long distances and steady volumes.

- Synchronization: Successful rail operations depend on tight coordination between vessel discharge, terminal handling, and inland train departures.

Businesses that treat rail as a predictable part of their logistics flow—rather than a backup option—gain the most benefit in both cost and performance.

Environmental and Regulatory Drivers for Modal Shift

Beyond efficiency, the shift to rail is also driven by sustainability goals. Moving freight by rail can reduce greenhouse gas emissions by up to 80% compared to trucks. Both the Rotterdam and Antwerp port authorities have set modal share targets to increase the proportion of containers moved by rail.

European climate regulations and environmental incentives further encourage this shift. For companies focused on ESG compliance or branding around sustainable supply chains, embracing Dutch rail freight offers both operational and reputational rewards.

Obstacles and Risk Factors

No transport mode is without its downsides. Rail freight is less flexible for short-haul or last-minute shipments, and terminal strikes or rail line disruptions can still cause delays. Limited yard capacity and congested rail corridors occasionally create backlogs similar to those seen on the roads.

Businesses can mitigate these risks by building contingency plans, such as maintaining reserve trucking capacity—and by working closely with intermodal operators to ensure schedule resilience. Rail should be viewed as the reliable “spine” of logistics operations, with other modes providing flexibility around it.

Best Practices for Businesses Using Dutch Rail Freight

To make the most of Dutch rail freight, companies should adopt a structured approach:

- Partner with experienced intermodal operators who maintain fixed train schedules from Rotterdam and Antwerp.

- Design rail-ready logistics flows, ensuring containers are packed, sealed, and delivered to the rail terminal according to schedule.

- Track key performance metrics such as dwell time, train utilization, and punctuality.

- Build buffer capacity to accommodate minor disruptions without compromising delivery promises.

In short, treat rail freight as a strategic asset—not just an alternative mode of transport.

The Next Decade of Dutch Rail Freight

Looking ahead, investment in infrastructure and technology will determine how far rail freight can go in easing port congestion. Ongoing improvements to the TEN-T corridors, terminal expansions, and digital scheduling systems are expected to enhance reliability and capacity across the network.

Between 2025 and 2030, the Netherlands aims to make rail a central pillar of its inland freight strategy. As automation, data-driven planning, and cross-border coordination improve, rail could well become the preferred mode for high-volume container flows out of Rotterdam and Antwerp.

Conclusion

As congestion continues to strain the ports of Rotterdam and Antwerp, Dutch Rail Freight stands out as both a practical and strategic solution. By transferring container movements from road to rail, companies can alleviate terminal bottlenecks, stabilize lead times, and meet their sustainability objectives—all while future-proofing their supply chains.

However, success depends on preparation. Businesses must align scheduling, choose experienced intermodal partners, and invest in rail-ready logistics processes. For many, this shift won’t just improve operations—it will redefine how they compete in a congested, capacity-tight Europe.

FAQs

- What kinds of goods are best suited to Dutch rail freight?

Containerized cargo with consistent volume and predictable schedules—such as retail goods, machinery, or automotive parts—benefits most from rail transport. - Is rail faster than trucking from Rotterdam or Antwerp?

While trucking can be more flexible, rail offers steadier transit times when ports and highways are congested, making overall delivery more predictable. - Does rail freight cost more than road transport?

On a per-trip basis, rail can seem more expensive, but over time and volume, it becomes cost-competitive—especially when factoring in avoided demurrage and delay penalties.