The Airfreight Capacity Crunch: What Dutch Exporters Need to Know in 2025

In 2025, Dutch exporters face a critical challenge in airfreight logistics. Capacity constraints, rising rates, global trade shifts, and increased demand—especially driven by e-commerce—are reshaping the market.

The Global Air Cargo Situation

Airfreight demand is growing globally, with volumes projected to increase by 6–10% in 2025. However, air cargo capacity is expanding at a slower pace, creating a growing gap that strains the industry. While new freighter aircraft are entering service, they cannot match the current surge in shipping demand, particularly on high-volume routes like Asia–Europe.

What’s Driving the Crunch?

A. E-Commerce Boom

E-commerce continues to fuel airfreight demand, especially for quick delivery across continents. Online retail’s double-digit growth is placing more pressure on air cargo networks.

B. Limited Fleet Expansion

Aircraft manufacturers are struggling with backlogs, and existing freighter fleets are aging. Passenger airlines have also scaled back international routes, reducing available belly-hold cargo space.

C. Geopolitical Disruptions

Events such as Middle East conflicts, airspace closures, and trade tensions (especially between China and the U.S.) are disrupting flight paths and capacity availability.

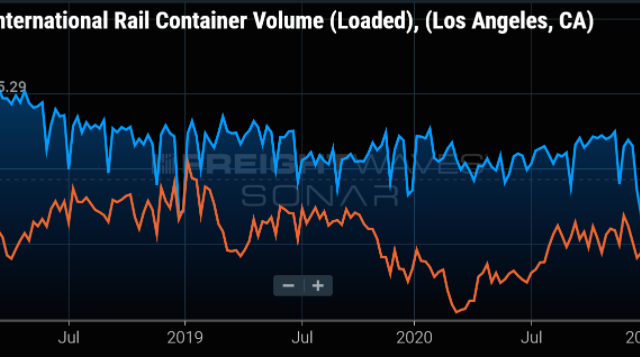

D. Ocean Freight Spillover

Port delays and ocean freight congestion are pushing more shippers toward airfreight, further tightening capacity.

Impact on Dutch Exporters

Higher Costs

Freight rates remain elevated due to limited space. Exporters can expect rate fluctuations, surcharges, and higher costs per kilogram.

Booking Difficulties

Securing space on aircraft is increasingly difficult, particularly during peak periods. Booking in advance is more critical than ever.

Shift in Routes and Carriers

Some European airlines have reduced long-haul cargo capacity, shifting opportunities to Asian and Middle Eastern carriers.

Smart Strategies for Dutch Exporters

Plan Early

Reserve cargo space well ahead of deadlines. Long-term contracts can offer better pricing and security.

Use Multi-Modal Shipping

Combine air and ocean freight to balance speed and cost. Reserve airfreight for high-value or time-sensitive goods.

Explore Alternative Carriers

Expand partnerships beyond traditional European airlines. Consider Middle Eastern and Chinese carriers with better route availability.

Watch for Regulatory Changes

Stay informed on international trade regulations, tariffs, and transit disruptions that could affect logistics.

Optimize Packaging

Efficient packaging reduces volumetric weight and shipping costs. Re-evaluate product dimensions and packaging strategies.

Future Outlook

While demand may soften slightly later in 2025, the imbalance between capacity and demand is expected to continue. Long-term fleet expansion will take years. Dutch exporters should prepare for ongoing volatility and continue refining their logistics strategies.

Key Takeaways for Dutch Businesses

| Challenge | Recommended Action |

| High freight rates | Lock in long-term or indexed contracts |

| Capacity constraints | Book early and diversify carriers |

| Shifting trade patterns | Adapt to new lanes (e.g., Northeast Asia) |

| Unpredictable disruptions | Build agile, responsive logistics plans |

| Weight-based pricing | Improve packaging efficiency |

FAQs:

Why is airfreight capacity tight in 2025?

Capacity is strained due to increased e-commerce demand, limited new freighter deliveries, geopolitical tensions, and disruptions in ocean freight that push more volume to air cargo.

How can I lower my airfreight shipping costs?

Book early, use indexed contracts, optimize packaging to reduce weight, and consider hybrid strategies combining ocean and air transport.

Which routes are most affected for Dutch exporters?

Asia–Europe and Europe–North America routes are most impacted. Some carriers are shifting away from Chinese routes, increasing reliance on Middle Eastern or Asian airlines.